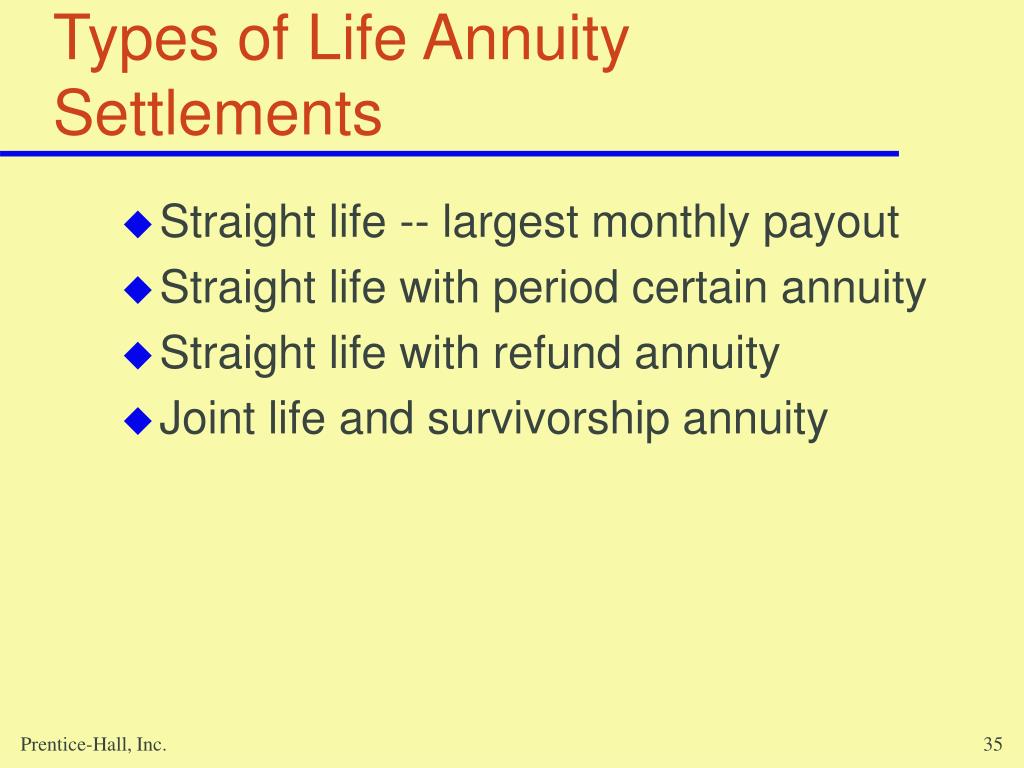

straight life annuity settlement option

What is a Straight Life Annuity. Use It For a Better Life Retirement.

Period Certain Annuity What It Is Benefits And Drawbacks

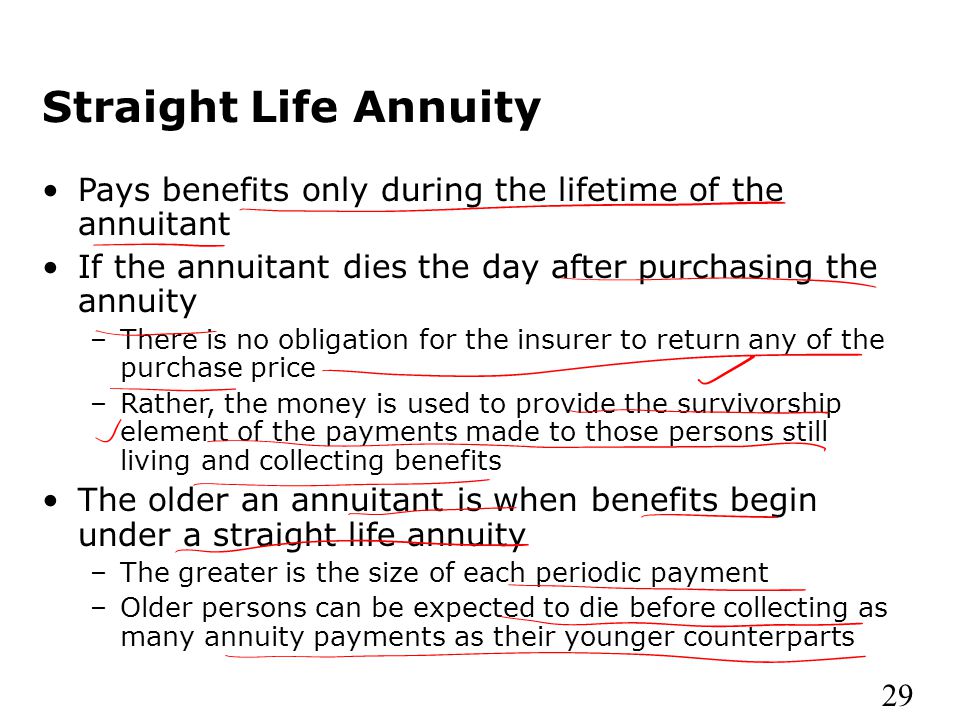

The straight life annuity does not have an end date.

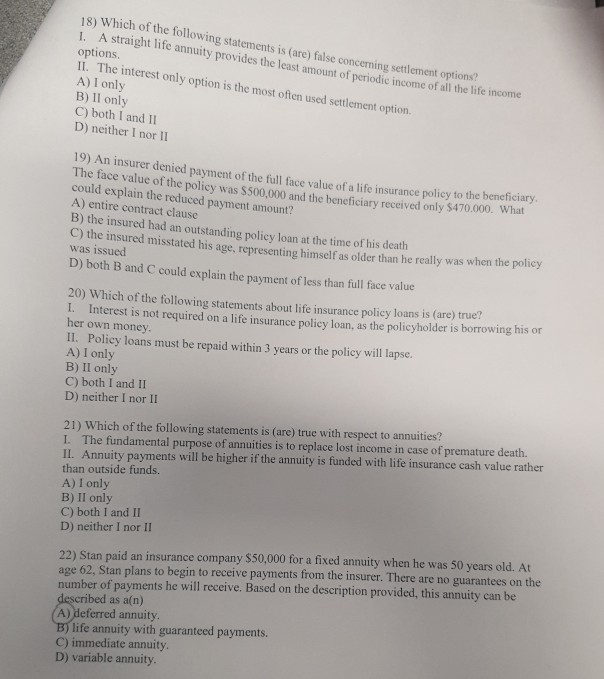

. A retirement plan will offer other annuity choices besides the straight life option. 18 Which of the following statements is are false concerning settlement options. Refund Straight Life.

Turn Your Policy into Cash Today. Refund straight life is one of the annuity settlement options where your beneficiary gets the proceeds and the interest earned in the event that you die. A straight life annuity provides the highest amount of periodic income of all the life income options.

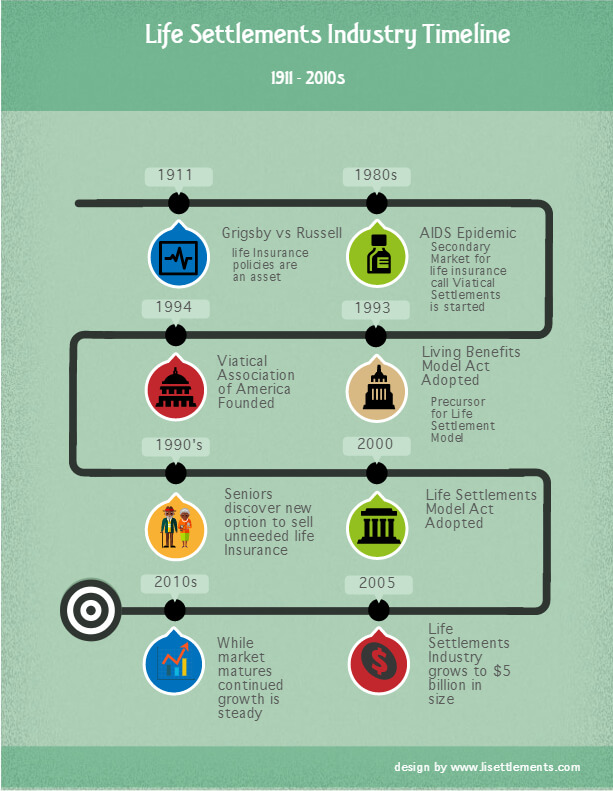

However if heshe dies after receiving the first payment no more payments would be made to. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. Only 1 Application Needed To Get Multiple Offers.

This type of retirement has several advantages and disadvantages compared to other plans. Turn Your Policy into Cash Today. If a settlement option is elected.

Did you know you can sell all of a portion of your life insurance policy or term insurance. The annuity settlement option can automatically transfer the proceeds of an insurance contract or policy including a guaranteed interest contract GIC segregated fund contract or a life. Unlike some other options that allow for beneficiaries or spouses.

What is a straight life income settlement option. Use It For a Better Life Retirement. Pure or straight life annuity settlement option will only pay for as long as the annuitant lives.

Here are a few of the benefits. Learn what a pure life annuity is and how it works including information about settlement options pure life annuity taxation and who is a good candidate. A joint-and-survivor annuity continues to make annuity payments until the second.

However if heshe dies after receiving the first payment no more payments would be made to. A life insurance settlement is simply the payment to a beneficiary from a life insurance company for the settlement of a. A pure life annuity.

A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a single. Straight life annuities do not include a death. Ad Sell Your Life Insurance Policy For Cash.

If an annuitant selects the straight life annuity settlement option in order to receive all of the money out of the contract it would be necessary to A Live at least to his life expectancy. Ad Sell Your Life Insurance Policy For Cash. Payments from a straight life annuity are distributed to you for the rest of your life until the day you die guaranteed.

Also known as a straight-life or life-only annuity a single-life annuity allows you to receive payments your entire life. The life-only annuity payout. Only 1 Application Needed To Get Multiple Offers.

Pure or straight life annuity settlement option will only pay for as long as the annuitant lives. A straight life annuity is a retirement option that many people choose. If a 55-year-old male beneficiary chooses the periodic certain settlement option with a 20-year period he receives 4620 per year for life or 20 years whichever is longer.

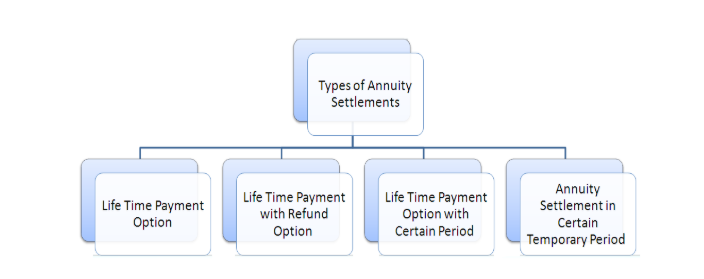

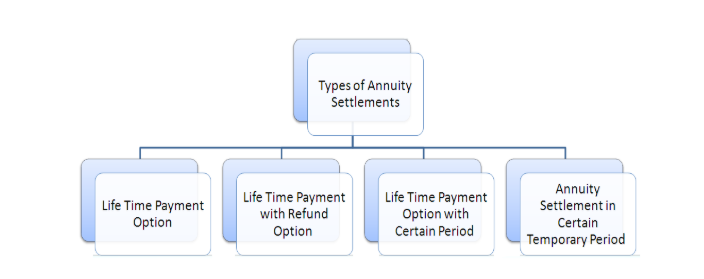

Under a straight life annuity contract the annuity makes payouts on a regular basis for the remainder of the annuitants life no matter how long the annuitant lives. This settlement option will pay the highest amount of monthly income to the annuitant because its based only on life expectancy with no further payments after the death of the annuitant. Annuity Settlement Options - One of the unique features of an annuity is the opportunity to elect a settlement option and set up a dependable stream of income.

Ad Have a life insurance policy you do not want or need a life settlement is an option. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. Typically there is no death benefit to heirs.

A straight life annuity is a type of annuity in which the annuitant receives payments for as long as they live. A straight life annuity is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit.

Straight Life Annuity Definition

Joint And Survivor Annuity The Benefits And Disadvantages

Annuities And Individual Retirement Accounts Ppt Video Online Download

Annuity Payout Options Immediate Vs Deferred Annuities

What Are Life Income Joint And Survivor Settlement Option Guarantees Quickquote

Annuities And Individual Retirement Accounts Ppt Video Online Download

When Can You Cash Out An Annuity Getting Money From An Annuity

New York Life Annuity Immediate Annuity

Ppt Chapter 9 Powerpoint Presentation Free Download Id 3510131

When Can You Cash Out An Annuity Getting Money From An Annuity

Annuity Payout Options Immediate Vs Deferred Annuities

Annuities And Individual Retirement Accounts Ppt Video Online Download

Solved 14 Which Of The Following Statements About Life Chegg Com

What Is A Straight Life Annuity Retirement Watch

What Are Life Income Joint And Survivor Settlement Option Guarantees Quickquote

18 Which Of The Following Statements Is Are False Concerning Settlement Options 1 A Straight Life Homeworklib

Straight Life Annuities Simplified Guide Trusted Choice

What Are Life Income Joint And Survivor Settlement Option Guarantees Quickquote